Banking is one of the sturdiest pillars of any country’s economy. People of any country rely on it heavily for managing their money. Strengthening it is important to offer safety to the people’s monies who maintain accounts with the banks.

The most important functions of banks are to provide loans of various kinds, offer a secure system to store people’s savings and to allow the businesses to do transactions in a trustworthy manner. All these functions give rise to the exchange of money. Reconciliation of these exchanges is a prime necessity.

Why is streamlining the bank reconciliations important?

A bank reconciliation is a process of matching the balances in an entity’s accounting records for a cash account to the individual information on a bank statement. The purpose of these tasks is to ascertain the differences between the two and to book changes to the accounting records as appropriate.

How will you feel when you have no idea how you used your money? It is sure to give you sleepless nights if you do not keep a record of the money.

The bank reconciliation process, therefore, is very important to give its users peace of mind. The reconciliation process streamlining is a wise move as it helps gain people’s confidence in the banking system. The streamlining process helps in the following ways:

- It allows the account holders to know about the movement of the money in their accounts

- It helps identify suspicious transactions and prevent frauds

- It helps ensure that the transactions are compliant with the regulations

- It allows people to know the source as well as the beneficiary of the funds that moved through their accounts

- It offers the correct account status to the owners at any point of time

Is RPA the best option for doing bank reconciliations?

Of course, yes! Gone are the days when the banking records’ reconciliation was possible to do only with Excel sheets using certain Macros. Though these did give us a glimpse of how automation of the process is to be done but clearly, it was not the complete solution. The use of Robotic Process Automation features delivered the following outcomes:

- It simplifies as well as speeds up the reconciliation process

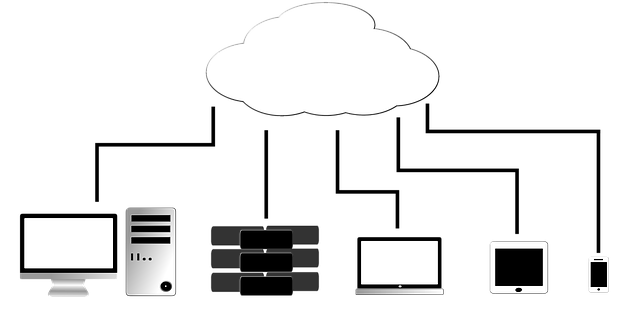

- It employs advanced tools like AI or machine intelligence to smartly tackle zillions of bytes of banking data

- It brings added accuracy in the reconciliation process and leaves no room for error – this is exactly what any user expects from the banking system!

- It can categorize the data relevance wise and apply checks in an automated manner to locate discrepancies of less serious to highly serious categories.

- It does not stop at locating the errors; in fact, its purview goes further and does corrections and highlights the corrections made to get the approvals.

As a result, all entities involved in the banking reconciliation process find it easy to simplify the transaction evaluation process. Most importantly, it ensures the privacy of data due to zero manual intervention in the process.

Types of discrepancies that can be avoided with robotics-based banking reconciliation

Before the use of robotics-empowered methods, the banking reconciliation process was subject to the following errors or discrepancies:

- The occurrence of duplicate entries due to human error

- Reconciliation of multiple transactions in a single entry put the checkers in a fix

- Simplest errors like misspelling, punctuations, and unwanted character typing compromised the quality of reconciliation reports

- Date format discrepancy due to the prevalence of different date formats across the globe

- Transactional delays caused due to different cut-off times of the regions, a discrepancy of system clocks, and differences in the timing of transactions

Thus, plugging such loopholes needed some advanced methods of reconciliation. This is where the robotics-enabled banking reconciliation stepped in and changed the way the records were checked and matched.

Robotic processes automation methods and tools make it easier to check the records using algorithmic support. This change proves its effectiveness in making banking more reliable, easily manageable, and highly competent in working.

Conclusion

Banking records consist of uncountable transactions happening day and night. The occurrence of the transactions goes beyond the banking hours due to internet banking facilities.

People living in various parts of the world and doing transactions according to their time zones, too, have made banking processes active 24 hours, literally. Thus, the need for automating the bank reconciliation process is quite evident and natural. You must hire only the best robotic process automation companies to ensure better credibility and accuracy of the banking system.